How important is the relationship between technology and financial leaders? Two words: game changer. Yet, according to Gartner, only “30% of CFO-CIO relationships can be described as strong digital partnerships – capable of outperforming their peers in financial management practices that are unique to funding digital.” One area where the two can work more closely together is travel and expense management. Why? Because business travel drives competition and revenue, and expenses are one of the largest sources of employee spending.

With greater distance between today and the pandemic, business travel continues to ramp up. Face-to-face is the new competitive advantage. One sales VP shared recently that he set down the theme for 2023 with his team: get off email and get in front of customers.

The VP’s sentiments are affirmed by SAP Concur surveys of 100 U.S. finance managers (vice president and above) and 1,000 U.S. business travelers. They found that most finance managers (88%) said their company experienced a revenue loss over the past year—an average of $106,670—as a direct result of employees’ inability to travel at pre-pandemic levels.

Business travelers are on the same page about the necessity. Nearly half (44%) said that their company needed an increase in business travel to remain viable beyond 2022, 35% said the same for their career, and 30% said the same for their entire industry.

Yet, 2023 brings a whole new set of uncertainties – primarily economic. That’s why I’ve assembled five questions – or the 5Qs – CFOs and CIOs can explore together that give a fuller spending picture on business travel.

CIOs and CFOs in the Sandbox: 5Qs to Explore

Here are five questions for CIOs and CFOs to explore to contain costs, improve traveler experiences and more efficiently track expenses in real time.

- Is the organization’s current expense solution unnecessarily using IT resources or outdated technology?

- The old adage “if it’s not broken, don’t fix it” holds companies back. An IDC research report found that roughly 80% of today’s AP managers’ time is spent on lower-level financial tasks, such as invoice matching, purchase requisition, and vendor management – all tasks that have the potential to be automated.

- Is there a backlog of enhancement requests or report creation requests from users that cannot be addressed in a reasonable amount of time?

- Finance isn’t seen as a sexy place to innovate by ERP providers. However, not investing in finance functionality is a mistake with long-term consequences. Companies that turn a blind eye and continue this path aren’t benefiting from the innovations being developed – from major cost savings across more areas of the business to growth opportunities for rising finance team talent.

- Has the vendor of the technology announced an “end-of-life” strategy for the product? Or is the product in “maintenance only” mode?

- Prepare for a technology’s “end of life” by transitioning to longer term solutions that create a more positive end-user experience, integrate travel data to give a company an end-to-end view of spend, or access to near, real-time data with insightful, visual reports.

- Is the organization favoring solutions that increase the end-user experience?

- According to a Forrester research report, “In the US, travel and expense software is considered the most important tool for enabling good employee experience.” The easier these processes are for employees, the more likely they will follow organizational protocols, budgets, and safety measures.

- Is the organization capturing all employee spend data in one place?

- With multiple platforms capturing and aggregating all employee spend, companies risk not being compliant with government or industry regulations and increase their chances of fraud. It takes, on average, 14 months to detect a fraud scheme, according to an ACFE report. The big takeaway is: simplify. When finance has control and visibility into the details of where and how company dollars are spent, it becomes easier to detect fraud quickly.

Financial Transformation: It’s Real-Time All the Way!

The role of money is evolving. Whether it’s touchless or automated payments, blockchain or a shiny new cryptocurrency wallet, change is here. One prediction, however, by Deloitte is on point: Finance is going real-time. There will be less reporting and more real-time visualization. Here, technology offers solutions.

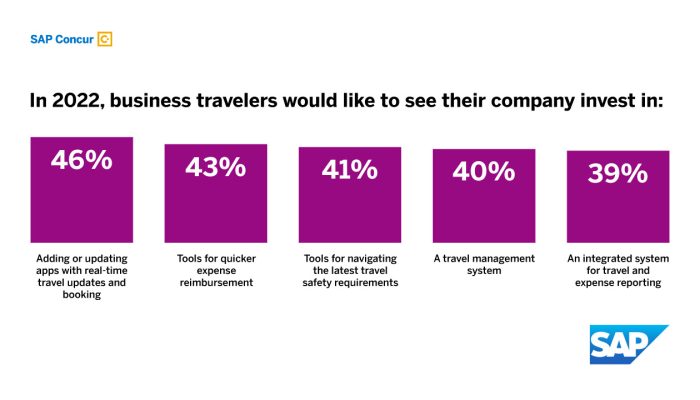

SAP Concur’s findings back this up: business travelers want to see their company invest in adding or updating apps with real-time travel updates and booking (46%), tools for quicker expense reimbursement (43%), and tools for navigating the latest travel safety requirements (41%). A travel management system (40%) and an integrated system for travel and expense reporting (39%) round out their top five.

Finance managers themselves see change as inevitable. The study revealed that 100% said that their role has changed — and has become more challenging — since the start of the pandemic.

Reasons include taking on additional work caused by staffing shortages (59%), additional auditing and paperwork requirements (45%), and new or added involvement in internal communications (45%). On average, they are spending six hours each week on these tasks. Tech solutions, like embedded machine learning and human verification, modernize finance.

CFO-CIO Team Requires Solving for X Together

Based on SAP Concur’s research, 66% of senior executives believe a strong partnership between IT and finance leaders enables the organization to remain agile in the face of unforeseen challenges. This I know: whether in my role as a parent, business advisor or board member, one of the best ways to get people pulling in the same direction is through a united pursuit of something bigger than themselves.

Start with these five questions – and watch amazing things unfold. As CIOs and CFOs tackle big issues together, like balancing the benefits of business travel against a “do more with less” business environment, they cover more ground and help everyone, including the travelers themselves, arrive at a better destination.

+++

SAP Concur is a platform used by more than 46,000 businesses to connect financial data with greater spending control. I’ve used SAP Concur’s travel, expense and invoicing platform even before it was acquired by SAP in 2014. Learn more about SAP Concur solutions here.